south dakota excise tax on vehicles

Motor vehicles not subject to motor vehicle excise tax include. Motor vehicle was on a licensed motor vehicle dealers.

Car Tax By State Usa Manual Car Sales Tax Calculator

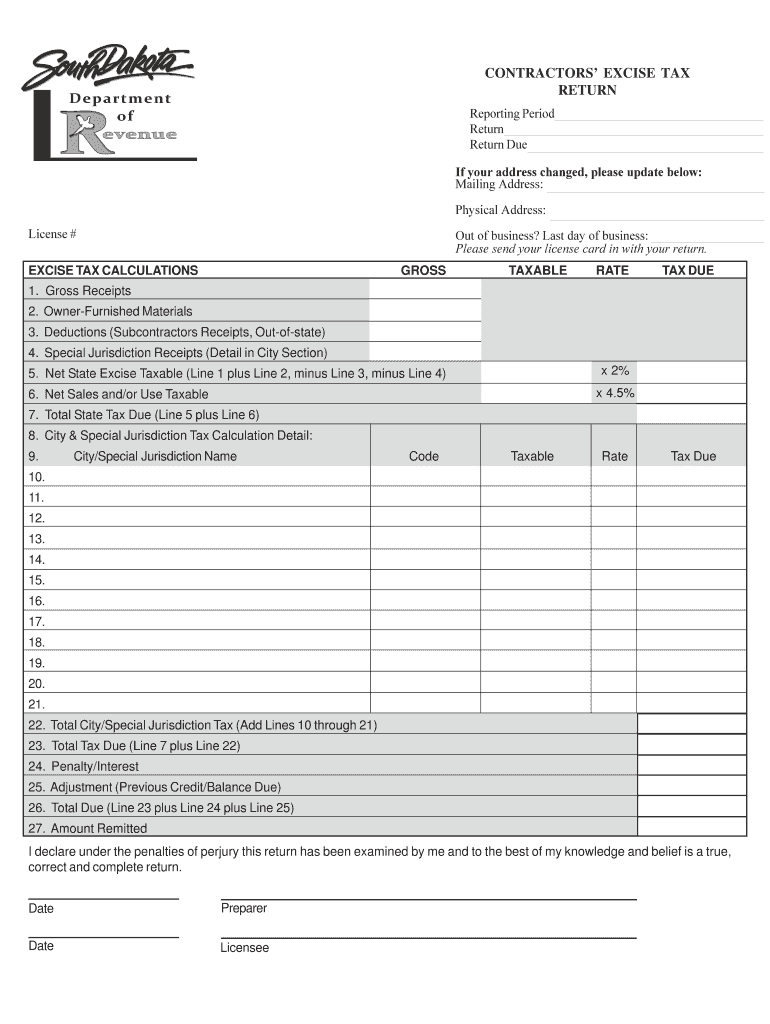

Contractors Excise Tax Any person entering into a contract for construction services as defined in Division C of the Standard Industrial Classification Manual of 1987 or engaging in services.

. Chapter 10-35 Electric Heating Power Water Gas Companies. Find information on which cigarettes are allowed to be sold in South Dakota. South Dakotas excise tax on gasoline is ranked 35 out of the 50.

Motor vehicle excise tax. Dealers are required to collect the state sales tax and any applicable. Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax.

In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and. Dealers are not required to collect or pay the motor vehicle excise tax on motor vehicles they sell. How Much Is Excise Tax On A Car In South Dakota.

1 be an enrolled member of a federally. 35th highest gas tax. If purchased in South Dakota an ATV is subject to the 4 motor vehicle excise tax.

Motorcycles cars pickups and vans that will be rented for 28 days or less. They sell that is subject to sales tax in South Dakota. Mobile Manufactured homes are subject to the 4 initial registration fee.

The South Dakota excise tax on gasoline is 2200 per gallon lower then 70 of the other 50 states. Title fee registration fees excise tax. Motor vehicle purchased prior to the June 1985 4 excise tax law or boat purchased prior to July 1 1993 excise tax law.

Out-of-state vehicle titled option of licensing in. If I paid Excise tax on a new vehicle in South Dakota can I claim that as sales tax. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles.

Order stamps pay excise tax find retailer information and report sales of tobacco products to businesses located. What is South Dakotas Wheel Tax. A lessee who entered into a lease prior to July 1 2000 and who paid excise tax based on the purchase price of the vehicle including the value of the leased vehicle at the end of the lease.

While the South Dakota sales tax of 45 applies to most transactions there are certain items that may be exempt from taxation. In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. South Dakota Vehicle Excise Tax Explained.

Per-Mile Costs of Road Improvements State Motor Fuel Tax Revenue State Motor Vehicle 4 Excise Tax Revenue Motor Fuel Taxes in Neighboring States Selected Gas Tax Statistics Per. This tax shall be in lieu. Division of Motor Vehicles 445 East Capitol Avenue Pierre SD 57501-3100 1.

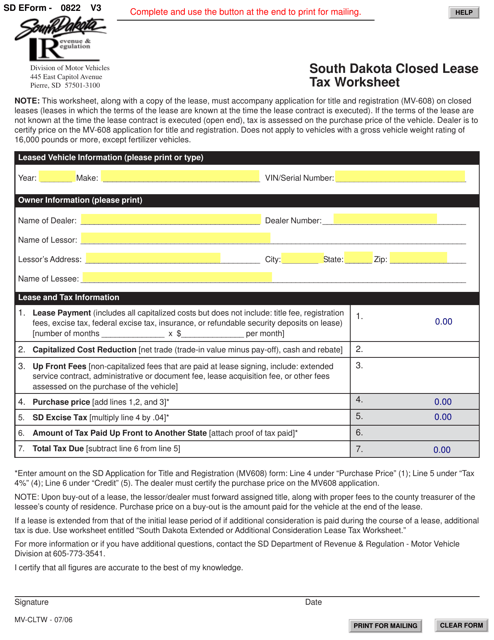

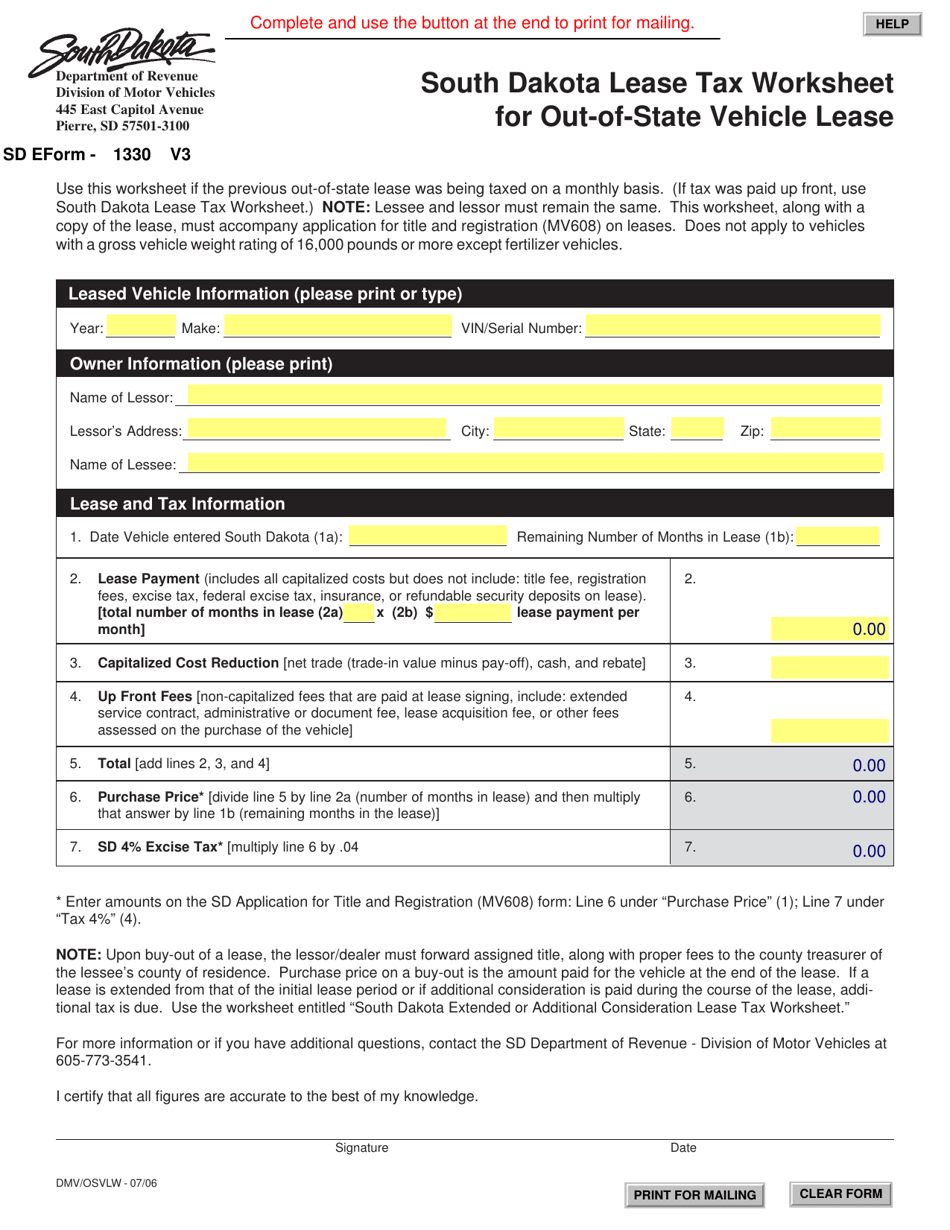

The first buyer is exempt if the dealer has paid the 4 excise tax and licensed a South Dakota titled vehicle according to exemption 36. However if purchased by an out of state business you will need to show proof of tax paid to your local. Lease Payment includes all capitalized costs but does not include.

A person shall pay an excise tax at the rate of four percent on the purchase of an off-road vehicle as defined by 32-3-1 and required to be titled pursuant to 32-20-12. Initiated in 1986 to help subsidize bridge and highway maintenance you pay the South Dakota wheel tax when you are registering your vehicle with. This page discusses various sales tax exemptions in South.

Chapter 10-36 Rural Electric Companies. South Dakota doesnt have income tax so thats why Im using sales tax. Owning a car can be rather expensive from the point of buying it.

To be exempt from South Dakotas motor vehicle excise tax imposed by SDCL 32-5B-1 at the time the vehicle is purchased the applicant must. Several examples of of items that exempt from South.

1928 Chrysler Imperial Series 80 Chrysler Imperial Chrysler Imperial

Nj Car Sales Tax Everything You Need To Know

Sd Form 0822 Mv Cltw Download Fillable Pdf Or Fill Online South Dakota Closed Lease Tax Worksheet South Dakota Templateroller

Dealer Vehicle Licenses South Dakota Department Of Revenue

Cars Trucks Vans South Dakota Department Of Revenue

Trucking South Dakota Department Of Revenue

Bernie Fuchs Art Google Search Automobile Advertising Classic Cars Muscle Mopar

State Form 55296 Download Fillable Pdf Or Fill Online Application For Vehicle Excise Tax Credit Refund Indiana Templateroller

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Sales Tax On Cars And Vehicles In South Dakota

Sd Contractor S Excise Tax Return Formerly Rv 011 Fill Out Tax Template Online Us Legal Forms

Motor Vehicles Sales Amp Repair State Of South Dakota

What S The Car Sales Tax In Each State Find The Best Car Price

Government Faqs South Dakota Department Of Revenue

Sd Form 1330 Download Fillable Pdf Or Fill Online South Dakota Lease Tax Worksheet For Out Of State Vehicle Lease South Dakota Templateroller

Individual Faqs South Dakota Department Of Revenue

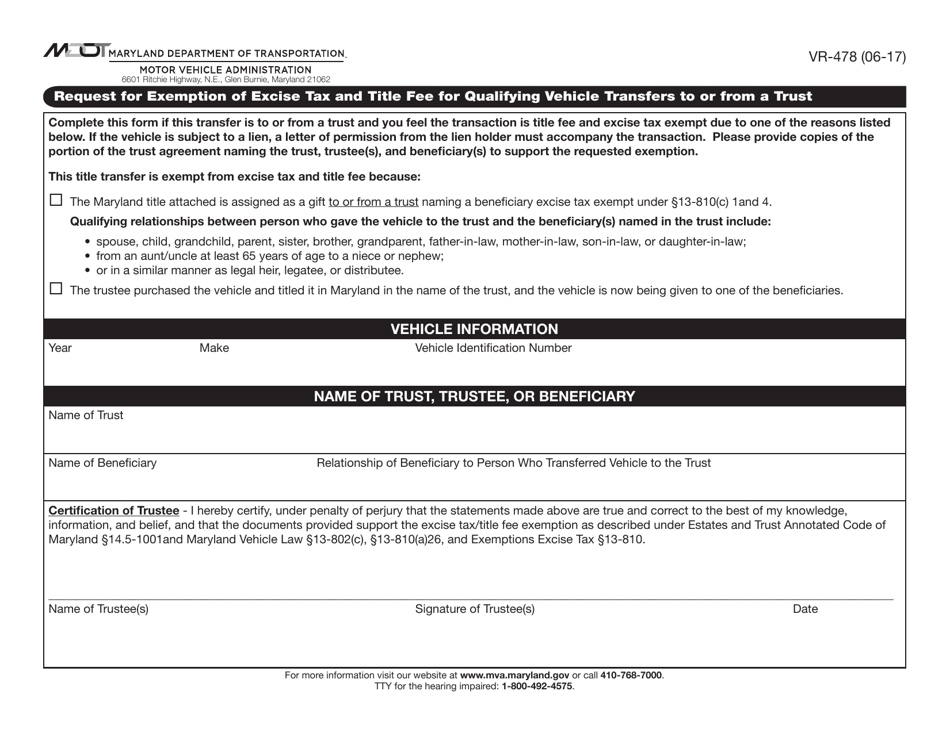

Form Vr 478 Download Fillable Pdf Or Fill Online Request For Exemption Of Excise Tax And Title Fee For Qualifying Vehicle Transfers To Or From A Trust Maryland Templateroller